EDITORIAL UPDATE

Management fundamentals

We have updated the editorial content of our « Management fundamentals » course. We also took the opportunity to restyle the course.

The update includes several types of changes:

- An editorial update

-

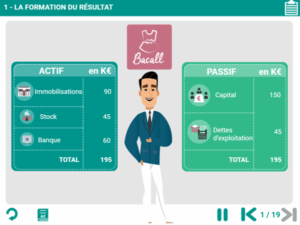

New graphics

- A more user-friendly interface

- New characters

These editorial and graphics updates are available in the following versions :

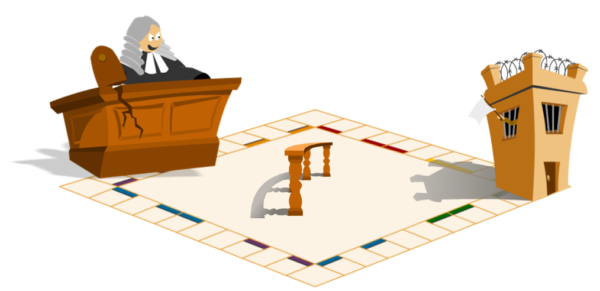

Overview of the new GRAPHICS

* If you would like to know more, consult out Management fundamentals course.